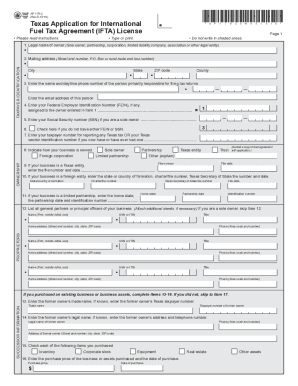

TX AP-178 2018-2024 free printable template

Get, Create, Make and Sign

How to edit ifta texas registration application online

TX AP-178 Form Versions

How to fill out ifta texas registration application

How to fill out IFTA Texas application:

Who needs IFTA Texas application:

Video instructions and help with filling out and completing ifta texas registration application

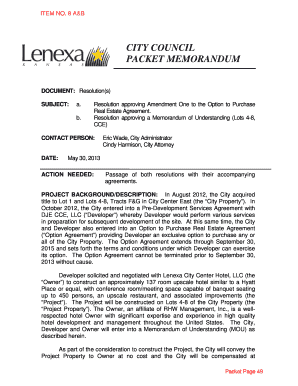

Instructions and Help about texas application international form

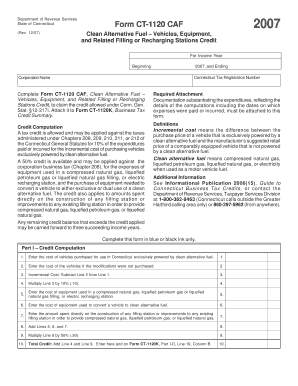

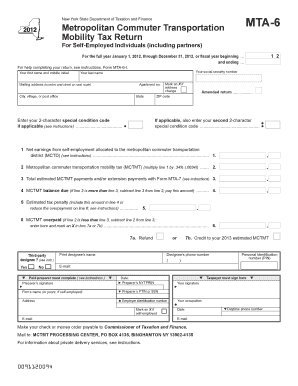

Hey what's up everybody is David McGill now in this video I had a question from a subscriber that asked if I can do a video explaining how to do if the tax returns so in this video I'm going to break down the information you need to complete your quarterly if the tax returns now before I get into the calculation let me explain what exactly if the even is so its spelled IFTA, and it's an acronym for International fuel tax agreement now basically what this is there is a tax that you pay on fuel and depending on where you purchase your fuel from versus where you're traveling the state where you paid the tax they may be required to split that money with the states that you drove in, so we have to file this tax return every quarter where we report the miles that we travel in each state along with the number of gallons of fuel we purchase in each state so now that we kind of have a general background of this quarterly tax filing I'm going to get into the break out of you know how I compute the information needed for its filing now its gone the actual filing itself is going to vary by state here in Indiana I filed my if two taxes for myself and for my clients online through the Indiana portal now if you live in a different state the portal may be different however the information that you're going to need in order to complete that tax return is going to be pretty Universal and standard across the board now the first thing you want to do when you're you know coming up with your work papers for your tax return is you want to look at how many miles you travel in each state for a particular quarter now where can you get that information from most companies are required to you know use electronic logs so pending on which electronic logging company you're using a lot of times the GPS trackers that are you know installed on the device they also track how many miles you're driving in each state so every quarter I look at my logs and I run the if the reports where I can see all right here are you know in this example I'm only traveling the Midwest in these five states well I can run my report and see how many miles are travel in each state, so that's the first thing you know that out that I put on my spreadsheet so for example’s sake lets say in Indiana I travel you know five thousand miles this quarter Kentucky lets say it was two thousand Ellen Of lets say five hundred lets say Ohio a thousand lets say Michigan 1500 so the total miles that I travel this quarter were 10000 miles, and again I was able to get this information from my electronic log reports once we have the miles travel the next important thing that we need is how many gallons of fuel we purchased in each state now how do we get that information well when you're buying fuel you're going to get a receipt so what I do is for my clients who are just you know they don't have a fuel car, and they just buy fuel you know as they need it you know paying in cash they drop off a ton of receipts to me, I go...

Fill texas ifta application : Try Risk Free

People Also Ask about ifta texas registration application

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ifta texas registration application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.